One of my clients recently asked me ‘Is the PED dead?’. Every POS terminal and ATM incorporates a PIN entry device (PED). The PED and the POS terminal are intrinsically linked because of the payment industry regulations that define the standard for smart chip cards. These standards also determine how POS terminals and ATMs can authenticate a cardholder with their card. Whether the POS terminal is nearing extinction is an excellent question that many companies in the industry are asking themselves. Retailers are especially interested in knowing the answer to this simple, yet strategic question, as they have a vested interest in the use of POS terminals.

The purpose of this article is to explore this question further and look how recent changes at the face to face interaction between the consumer (i.e. cardholder or smartphone user) and the retailer could prolong the life of the POS terminal or even kill it off entirely.

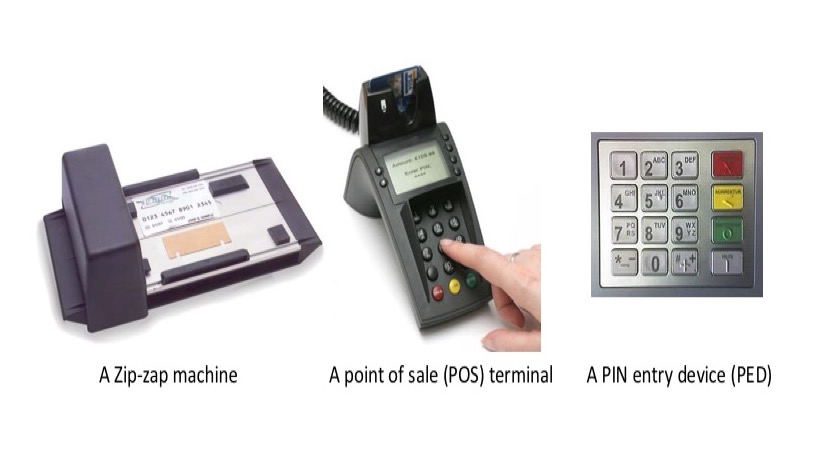

Today, it is hard to imagine buying a coffee that involves a zip-zap machine, where the consumer and the retailer fill in a paper receipt to record the transaction. Consumers are more likely to wave a contactless payment card or smartphone across the POS terminal to complete their payment.There are two initiatives that retailers are expected to see as their POS terminals increase in function beyond just accepting payments. Firstly, access to an app store and secondly, to turn the POS screen into a billboard for advertising. Although, marketing content being displayed on the POS screen is more common in North American retailers, we are expecting to see more of this in Europe. There are two additional factors where the POS terminal is changing its form factor that will remove the need for a numeric keyboard used for PIN entry. These are contactless payments and the adoption of ‘PIN-on-glass’ technology.Therefore, to properly answer the question whether the POS terminal is nearing extinction we should review the role of apps and marketing content at the POS, contactless payments and PIN-on-glass.

App marketplaces

Seeing non-payment services, such as mobile top-up or bill payment, as part of the POS terminal is common. The growth of the software portion of the POS will be driven by the increasing demand for non-payment related services which are categorised into:

- Business management - such as inventory management, accounting and reporting

- Consumer engagement - such as loyalty and consumer rewards

- Incremental sales - such as lottery tickets, mobile phone top-ups or the sale of product warranties

One of the most popular non-payment related services, in the business management category, has been data analytics and reporting – software that can provide a comprehensive analysis of sales across the retailer’s estate of POS terminals. This is an interesting phenomenon because it implies that the merchant acquirers are not serving their clients very well if the retailers must fulfil their need for data analytics elsewhere.

In the last few years the increase in non-payment services has led to the POS manufacturers to create a ‘marketplace’ where retailers can choose among a wide range of applications, and therefore, allow them to customise their POS solution specific for their business needs. Effectively, an app store, just like Google Play or Apple’s App Store, these marketplaces provide third party software developers a distribution platform where they sell their apps for downloading to the POS terminal.

One representative of an app marketplace enthusiastically told me that a taxi app would allow a restaurateur to book a taxi for their guests at the table while they settle their bill. Although a lot of restaurant guests would prefer the control and transparency by using the Uber app on their smartphone. So why would there be any motive to use a taxi app on the POS terminal? On the other hand, inventory management apps, such as Stitch Labs, seems like a much more promising proposition. Stitch Labs gives the retailer greater visibility, control, and insight of their inventory. There is an even an app that will calculate how many vegetables a restaurant will need based on the previous evening’s order data, the items on the menu and the potential influence of the weather forecast.

This and a host of loyalty and customer relationship marketing apps are generating some relevance amongst small businesses. However, will all this smart software really work on a POS terminal? Shouldn’t all this business management software be operated on a PC, a laptop or even a tablet where the computing power and the screen size is so much more than a POS terminal? The challenge has historically been the lack of real-time transaction data. Now as more and more POS terminals are being connected to the internet via fast broadband the hardware can share transaction data (or at least data that the payment card industry does not deem to be too sensitive) with business management apps. These apps operating in real-time will allow the shop owner to monitor transactions at a single POS terminal or several POS terminals in a single store or across several stores. So, a POS terminal with access to an app marketplace does make sense.

Marketing content

With 80% to 90% of all transactions occurring in-store, many retailers are wishing to utilise idle POS screens as a marketing channel – pushing advertising content or even personalised offers to consumers as they transact. With the ability to reach a point of interaction with greater precision, POS content management will enable retailers to deliver targeted offers and communications to customers at the POS terminal alongside their paper or digital receipts.

Pushing marketing content to the POS device is easier said than done. Not all devices are connected to the internet and in the US, where POS advertising is a more mature offering than in other markets, the POS device is rarely directly connected to the internet but sits behind an Electronic Cash Register (ECR) or Electronic POS system operated on a private network. Furthermore, advertising content is typically made up of larger files (rich digital images and movies) which require more connection time to download to the POS device.

Advertising or even targeted offers at the POS has yet to been seen to be a regular occurrence outside North America. Marketing content at the POS does need some thorough consideration, especially if it was perceived to be an invasive or disruptive to the normal customer experience. Turning the POS into a billboard for advertising places a greater emphasis on the POS providing the retailer with potentially an enhanced return on investment. Retailers love a positive return on investment, therefore, it is conceivable it will prolong the life of POS terminal and provide both retailers and consumers with real-time tangible benefits at the point of interaction.

Contactless payments

Here in the UK contactless has finally become mainstream. It has taken 7 or 8 years for consumers and merchants to become comfortable with the tap and pay concept which does not require a PED. Around 48% of all card transactions in the pubs and bars in the UK are contactless. For some odd reason, 63% of all card transactions are contactless in bakeries. The UK Card Association said that contactless payments during the first two months of 2017 experienced a 169% year on year increase. The rapid adoption of contactless payments also has been witnessed in Australia, Canada, Japan, Poland, Singapore, South Korean and Sweden.

Contactless reduces the number of moving parts in the hardware device to zero, thus making POS terminals last longer, and the use of the PED becomes irrelevant. Contactless is also encouraging consumers to carry less cash, which has impacted charities which rely on the public donating their spare cash. With the decline of cash, contactless charity boxes are expected to be widely introduced after a recent trial by Barclays.

PIN-on-glass

One repercussion that app marketplaces are likely to have for the POS terminal has been the fact that the tablet is an ideal form factor for a POS terminal. It gives both the merchant and the consumer a nice large screen to research, view and select products in the store. It’s mobile and it’s intuitive to use. By using ‘PIN-on-glass’ technology there is no need for an old-fashioned numeric keypad for PIN entry.

PIN Transaction Security (PTS) permits touchscreen technology, thus allowing a PIN to be entered via the touchscreen on a compliant device. We expect to see much more of this in the future. The physical numeric keyboard used for a PED could be rapidly disappearing as consumers become more comfortable entering their PIN on a touchscreen of a tablet or a smartphone or even the smart TV screen found in a fashion store’s changing room.

Contactless payments combined with PIN-on-glass (where the purchase amount is larger than the contactless threshold) will mean that the archaic numeric keyboard becomes a waste of space and cost. Soon there may not be a checkout in the traditional sense of the term. The point of interaction with the consumer is changing and PIN-on-glass will be one of those changes that will encourage retailers to re-think the point of interaction with the consumer and the role of the traditional POS terminal will further be eroded.

Can you withdraw cash from an ATM without a PED? Yes, one option is to make the ATM contactless, which is exactly what Australian bank ANZ did when they launched ‘Tap & PIN’ ATM. Just like the contactless POS terminal, it works by reading card data without having to insert the card in the reader. In this case, the PED is there when the amount is over the contactless threshold. In the UK, Barclays are piloting a similar notion on 600 of their ATMs and since January 2017 customers can use the Barclays mobile banking app to pre-enter their PIN and the amount of cash they would like to withdraw.

Conclusion

There have been some extraordinary changes in consumer behaviour, such as the rapid adoption of contactless and the use of easy touchscreen technology. Changes in the face to face transaction have also seen technological advances in security and consumer authentication. Since the early days of the zip-zap machine the amount of change in the POS terminal has been concentrated in the last 15 years of the 60 years since the first magnetic stripe reader was invented. Chip and PIN is more than 13 years old, yet we still see a magnetic stripe reader on a POS terminal. The app marketplace, advertising content and targeted offers at the POS are examples of tactical, yet small incremental enhancements in POS functionality which will prolong the existence of the POS terminal. However, PIN-on-glass and contactless are expected to weaken the reliance of the POS terminal in its current form.

As with the paperless office or the cashless society the retailer without a POS terminal is not likely to happen in the next 20 or 30 years. Conversely, PIN-on-glass and contactless devices without a PED are more likely to be mainstream within the next 5 years but retailers will still want the choice to accept cards with and without the PED. Just as we have seen the magnetic stripe reader is still an integral part of the POS terminal its days are numbered because in the next few years the mag-stripe card will fade away entirely as the chip on the card and contactless technology becomes the only standard. The next 10 years will see further advancements in the function of the POS terminal, it will not be comparable with anything we see today but software will take the lead not the hardware.

Acquirers and omnichannel retailers need to prepare for an increasingly changing payments landscape. Edgar, Dunn & Company (EDC) assists retailers, acquirers and technology companies to prepare for the future and establish a payment acceptance strategy which is optimised for your consumers. Accepting cash, cards and alternative methods of payment, including mobile wallets, has huge implications for the customer experience at the POS. Should you wish to offer your consumers a new payment method or if you are accepting payments, EDC uses its ‘360° Payments Diagnostic’ to navigate the future of payments.

Mark is a Director in the London office and heads up the Retailer Payments Practice for EDC. He has over 25 years of experience of consulting strategy in the payments and fintech industries. Mark works with leading global merchants, and payment suppliers to retailers, to develop omnichannel acceptance strategies. He uses the 360° Payment Diagnostic methodology developed by EDC to identify cost efficiencies and new growth opportunities for retailers by defining an appropriate mix of payment methods, acceptance channels, innovative consumer touchpoints, and optimizing Payment Service Providers and acquiring relationships. Outside the payments and fintech industry Mark is a passionate snowboarder.

.webp)

.webp)

.webp)

.webp)

.webp)